If there’s one piece of accounting jargon that trips people up the most, it’s “debits and credits.”

What exactly does it mean to “debit” and “credit” an account? Why is it that debiting some accounts makes them go up, but debiting other accounts makes them go down? And why is any of this important for your business?

Here’s everything you need to know.

What are debits and credits?

In a nutshell: debits (dr) record all of the money flowing into an account, while credits (cr) record all of the money flowing out of an account.

What does that mean?

Most businesses these days use the double-entry method for their accounting. Under this system, your entire business is organized into individual accounts. Think of these as individual buckets full of money representing each aspect of your company.

For example:

When your business does anything—buy furniture, take out a loan, spend money on research and development—the amount of money in the buckets changes.

Recording what happens to each of these buckets using full English sentences would be tedious, so we need a shorthand. That’s where debits and credits come in.

When money flows into a bucket, we record that as a debit (sometimes accountants will abbreviate this to just “dr.”)

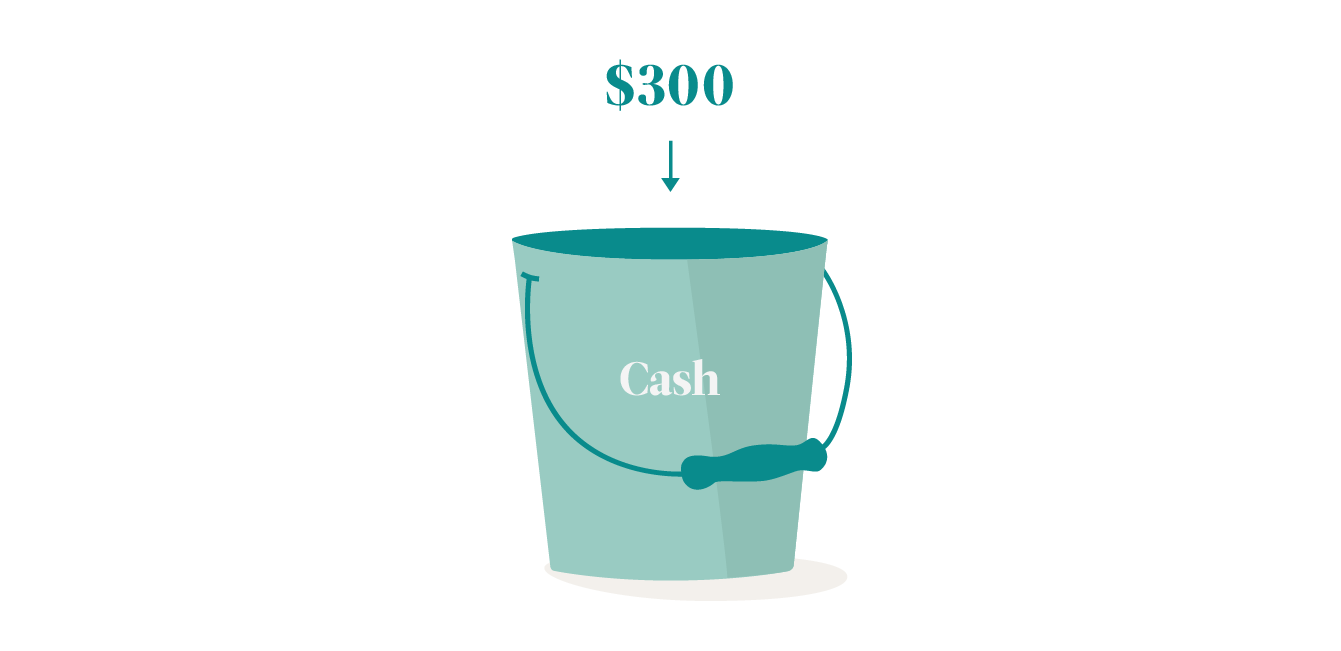

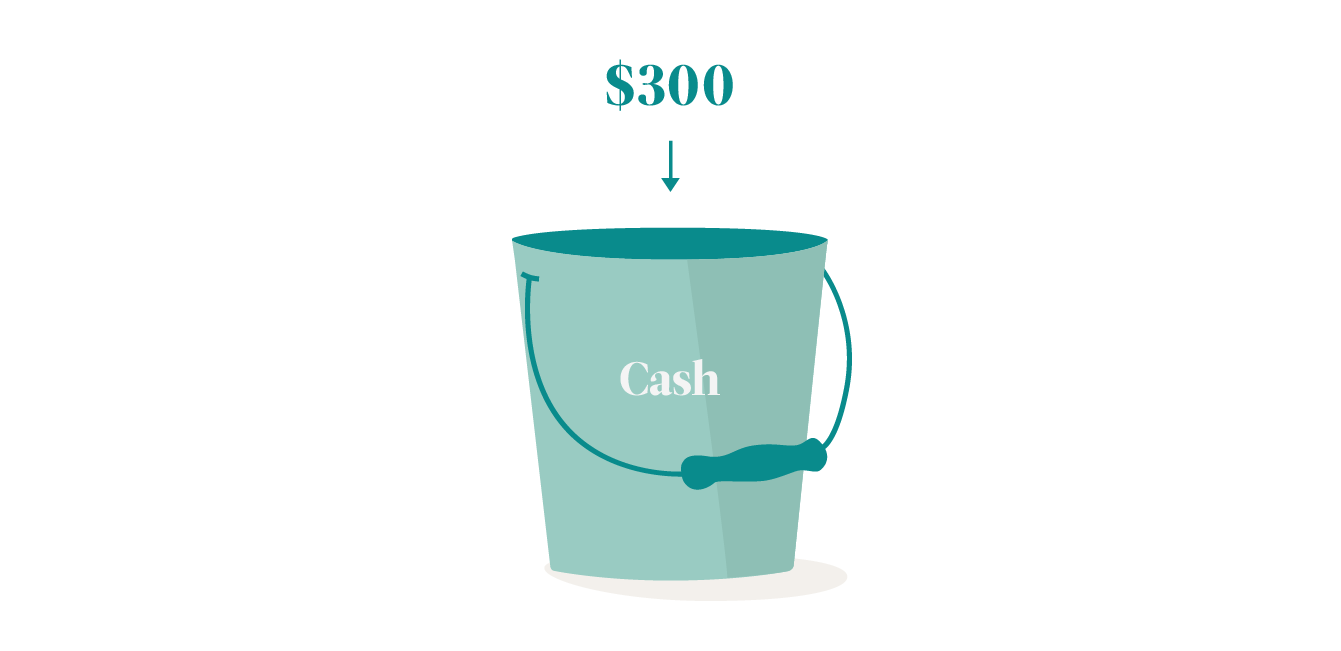

For example, if you deposited $300 in cash into your business bank account:

An accountant would say we are “debiting” the cash bucket by $300, and would enter the following line into your accounting system:

When money flows out of a bucket, we record that as a credit (sometimes accountants will abbreviate this to just “cr.”)

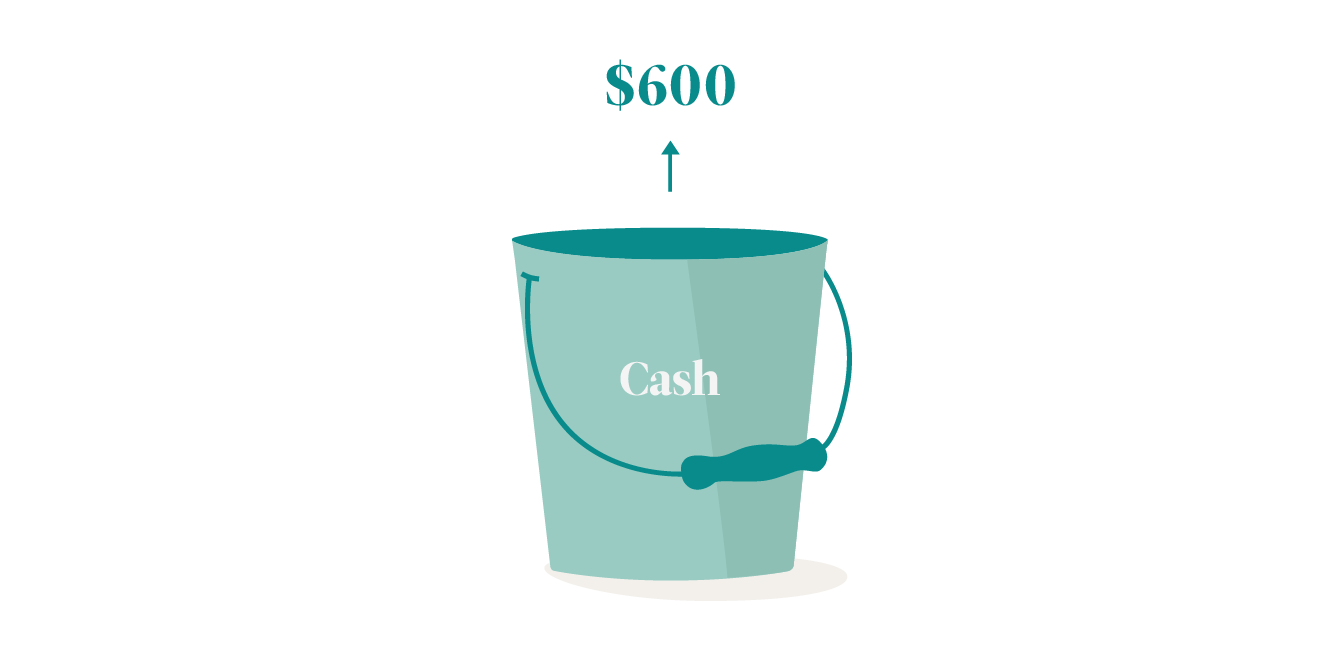

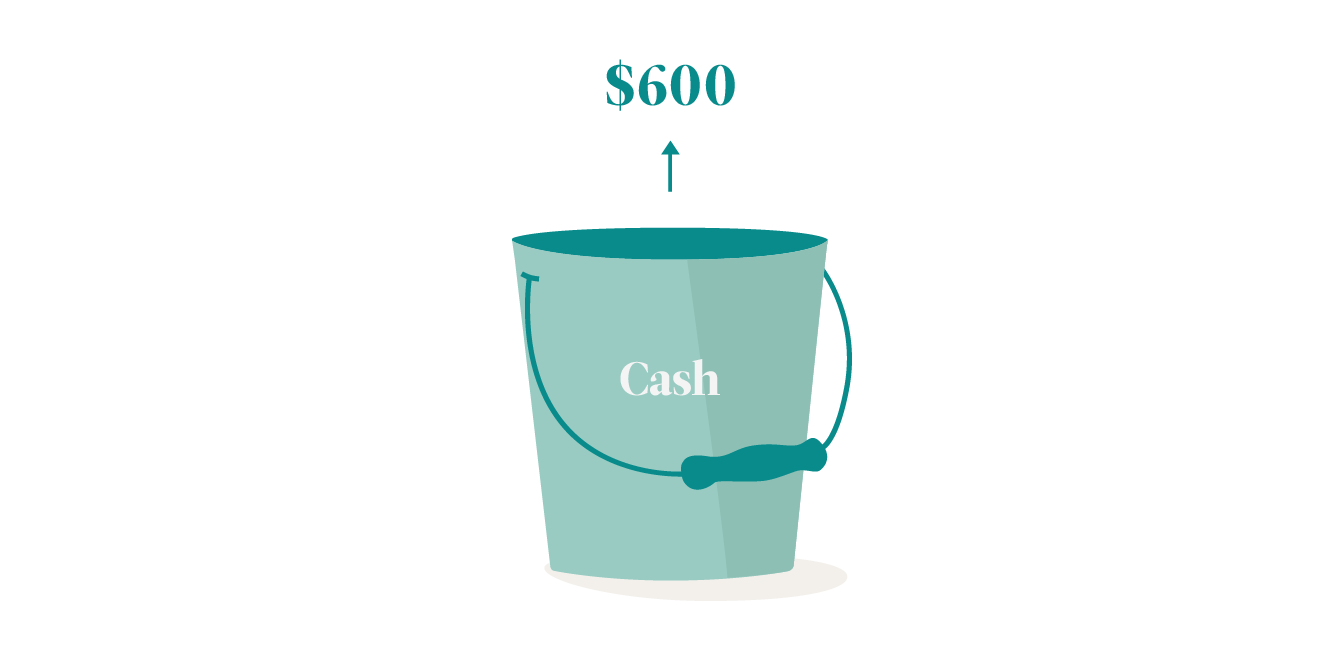

For example, if you withdrew $600 in cash from your business bank account:

An accountant would say you are “crediting” the cash bucket by $600 and write down the following:

Debits and credits in action

There’s one thing missing from the examples above. Money doesn’t just disappear or appear out of nowhere. It has to come from somewhere, and go somewhere.

That’s what credits and debits let you see: where your money is going, and where it’s coming from.

Let’s say that one day, you visit your friend’s startup. After taking a tour of the office, your friend shows you a beautiful ergonomic standing desk. You’ve been looking for this model for months, but all the furniture stores are sold out. Your friend ordered an extra one, and she can sell it to you for cheap. You agree to buy it from her for $600.

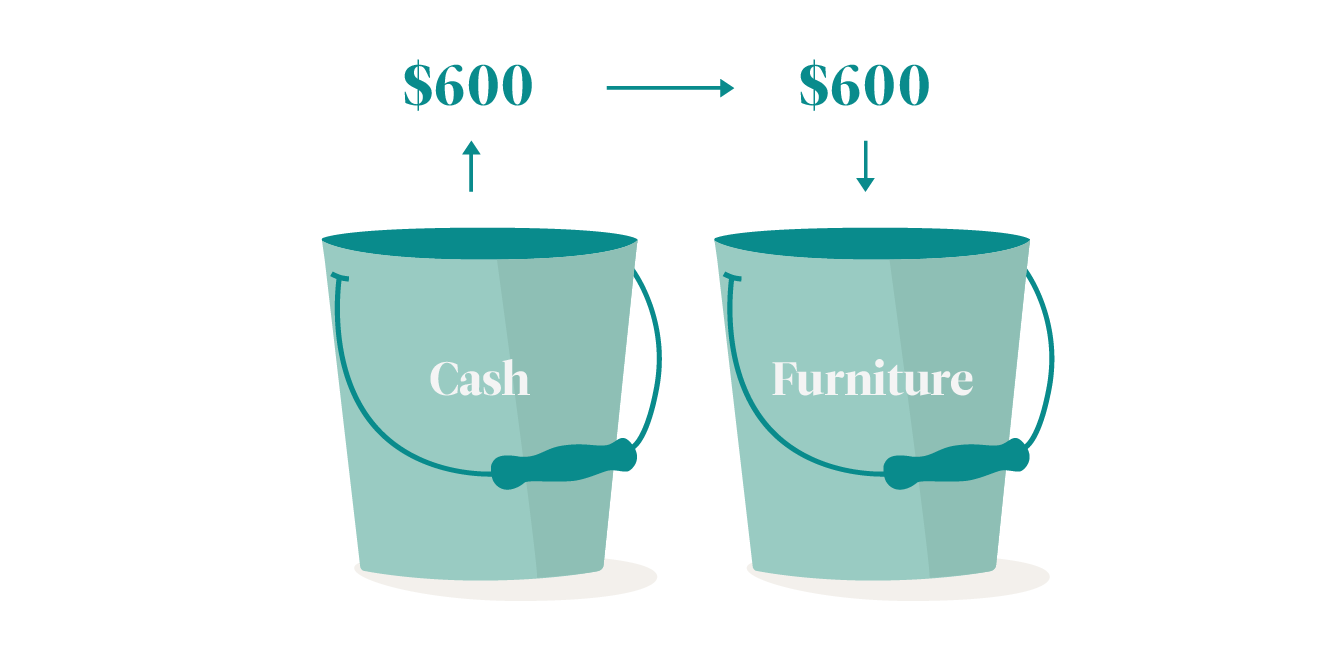

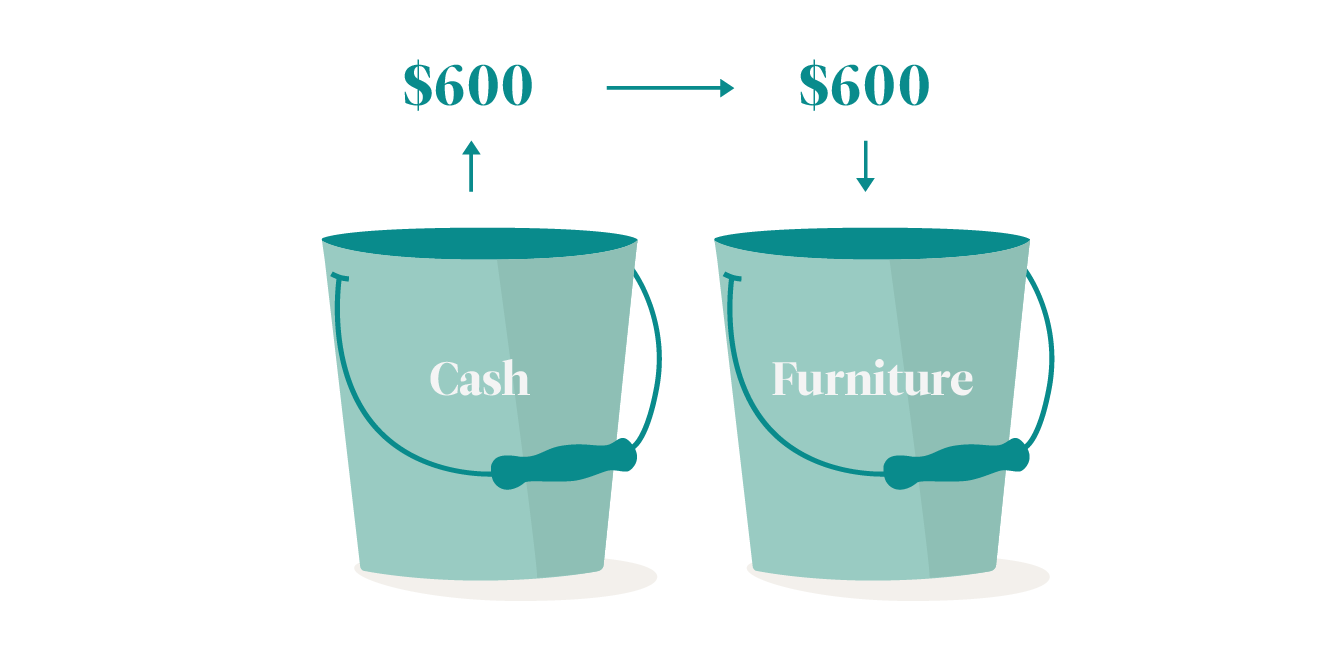

Here’s what that would look like using our bucket system. First, we move $600 out of your cash bucket.

Just like in the above section, we credit your cash account, because money is flowing out of it.

But this isn’t the only bucket that changes. Your “furniture” bucket, which represents the total value of all the furniture your company owns, also changes.

In this case, it increases by $600 (the value of the chair).

You debit your furniture account, because value is flowing into it (a desk).

In double-entry accounting, every debit (inflow) always has a corresponding credit (outflow). So we record them together in one entry.

In this case, the entry would be:

An accountant would say that we are crediting the bank account $600 and debiting the furniture account $600.

How debits and credits affect liability accounts

The two buckets we used in the above example—cash and furniture—are both asset buckets. (That is, they keep track of something you own.)

But not all buckets are asset buckets. Some buckets keep track of what you owe (liabilities), and other buckets keep track of the total value of your business (equity).

Let’s imagine that after buying that expensive desk, you want to get some extra cash for your business. So you take out a $1,000 bank loan, and you increase (debit) your cash account by $1,000.

Now here’s the tricky part.

In addition to adding $1,000 to your cash bucket, we would also have to increase your “bank loan” bucket by $1,000.

Why? Because your “bank loan bucket” measures not how much you have, but how much you owe. The more you owe, the larger the value in the bank loan bucket is going to be.

In this case, we’re crediting a bucket, but the value of the bucket is increasing. That’s because the bucket keeps track of a debt, and the debt is going up in this case.

An accountant would record that the following way:

How debits and credits affect equity accounts

Let’s do one more example, this time involving an equity account.

Let’s say your mom invests $1,000 of her own cash into your company. Using our bucket system, your transaction would look like the following.

First, your cash account would go up by $1,000, because you now have $1,000 more from mom.

But that’s not the only bucket that changes. You mom now has a $1,000 equity stake in your business—so the bucket labelled “equity (Mom)” also increases by $1,000:

An accountant would record that the following way:

Why is it that crediting an equity account makes it go up, rather than down? That’s because equity accounts don’t measure how much your business has. Rather, they measure all of the claims that investors have against your business.

The Equity (Mom) bucket keeps track of your Mom’s claims against your business. That’s her equity, not your business’s. In this case, those claims have increased, which means the number inside the bucket increases.

Debits and credits chart

Most people will use a list of accounts so they know how to record debits and credits properly.

A cheat sheet like this is an easy way to remember debits and credits in accounting:

And if that’s too much to remember, just remember the words of accountant Charles E. Sprague:

“Debit all that comes in and credit all that goes out.”

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. Bench assumes no liability for actions taken in reliance upon the information contained herein.

Credits go to the author of this post which is sourced from here

bench.co

bench.co

What exactly does it mean to “debit” and “credit” an account? Why is it that debiting some accounts makes them go up, but debiting other accounts makes them go down? And why is any of this important for your business?

Here’s everything you need to know.

What are debits and credits?

In a nutshell: debits (dr) record all of the money flowing into an account, while credits (cr) record all of the money flowing out of an account.

What does that mean?

Most businesses these days use the double-entry method for their accounting. Under this system, your entire business is organized into individual accounts. Think of these as individual buckets full of money representing each aspect of your company.

For example:

- One bucket might represent all of the cash you have in your business bank account (the “cash” bucket)

- Another bucket might represent the total value of all the furniture your business has in its office (the “furniture” bucket)

- Another bucket might represent a bank loan you recently took out (the “bank loan” bucket)

When your business does anything—buy furniture, take out a loan, spend money on research and development—the amount of money in the buckets changes.

Recording what happens to each of these buckets using full English sentences would be tedious, so we need a shorthand. That’s where debits and credits come in.

When money flows into a bucket, we record that as a debit (sometimes accountants will abbreviate this to just “dr.”)

For example, if you deposited $300 in cash into your business bank account:

An accountant would say we are “debiting” the cash bucket by $300, and would enter the following line into your accounting system:

| Account | Debit | Credit |

|---|---|---|

| Cash | $300 |

When money flows out of a bucket, we record that as a credit (sometimes accountants will abbreviate this to just “cr.”)

For example, if you withdrew $600 in cash from your business bank account:

An accountant would say you are “crediting” the cash bucket by $600 and write down the following:

| Account | Debit | Credit |

|---|---|---|

| Cash | $600 |

Debits and credits in action

There’s one thing missing from the examples above. Money doesn’t just disappear or appear out of nowhere. It has to come from somewhere, and go somewhere.

That’s what credits and debits let you see: where your money is going, and where it’s coming from.

Let’s say that one day, you visit your friend’s startup. After taking a tour of the office, your friend shows you a beautiful ergonomic standing desk. You’ve been looking for this model for months, but all the furniture stores are sold out. Your friend ordered an extra one, and she can sell it to you for cheap. You agree to buy it from her for $600.

Here’s what that would look like using our bucket system. First, we move $600 out of your cash bucket.

Just like in the above section, we credit your cash account, because money is flowing out of it.

But this isn’t the only bucket that changes. Your “furniture” bucket, which represents the total value of all the furniture your company owns, also changes.

In this case, it increases by $600 (the value of the chair).

You debit your furniture account, because value is flowing into it (a desk).

In double-entry accounting, every debit (inflow) always has a corresponding credit (outflow). So we record them together in one entry.

In this case, the entry would be:

| Account | Debit | Credit |

|---|---|---|

| Furniture | $600 | |

| Cash | $600 |

An accountant would say that we are crediting the bank account $600 and debiting the furniture account $600.

How debits and credits affect liability accounts

The two buckets we used in the above example—cash and furniture—are both asset buckets. (That is, they keep track of something you own.)

But not all buckets are asset buckets. Some buckets keep track of what you owe (liabilities), and other buckets keep track of the total value of your business (equity).

Let’s imagine that after buying that expensive desk, you want to get some extra cash for your business. So you take out a $1,000 bank loan, and you increase (debit) your cash account by $1,000.

Now here’s the tricky part.

In addition to adding $1,000 to your cash bucket, we would also have to increase your “bank loan” bucket by $1,000.

Why? Because your “bank loan bucket” measures not how much you have, but how much you owe. The more you owe, the larger the value in the bank loan bucket is going to be.

In this case, we’re crediting a bucket, but the value of the bucket is increasing. That’s because the bucket keeps track of a debt, and the debt is going up in this case.

An accountant would record that the following way:

| Account | Debit | Credit |

|---|---|---|

| Cash | $1,000 | |

| Bank Loan | $1,000 |

How debits and credits affect equity accounts

Let’s do one more example, this time involving an equity account.

Let’s say your mom invests $1,000 of her own cash into your company. Using our bucket system, your transaction would look like the following.

First, your cash account would go up by $1,000, because you now have $1,000 more from mom.

But that’s not the only bucket that changes. You mom now has a $1,000 equity stake in your business—so the bucket labelled “equity (Mom)” also increases by $1,000:

An accountant would record that the following way:

| Account | Debit | Credit |

|---|---|---|

| Cash | $1,000 | |

| Equity (Mom) | $1,000 |

Why is it that crediting an equity account makes it go up, rather than down? That’s because equity accounts don’t measure how much your business has. Rather, they measure all of the claims that investors have against your business.

The Equity (Mom) bucket keeps track of your Mom’s claims against your business. That’s her equity, not your business’s. In this case, those claims have increased, which means the number inside the bucket increases.

Debits and credits chart

Most people will use a list of accounts so they know how to record debits and credits properly.

A cheat sheet like this is an easy way to remember debits and credits in accounting:

| Debit | Credit |

|---|---|

| Increases an asset account | Decreases an asset account |

| Increases an expense account | Decreases an expense account |

| Decreases a liability account | Increases a liability account |

| Decreases an equity account | Increases an equity account |

| Decreases revenue | Increases revenue |

| Always recorded on the left | Always recorded on the right |

And if that’s too much to remember, just remember the words of accountant Charles E. Sprague:

“Debit all that comes in and credit all that goes out.”

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. Bench assumes no liability for actions taken in reliance upon the information contained herein.

Credits go to the author of this post which is sourced from here

Debits VS Credits: A Simple, Visual Guide

A simple, visual guide to debits and credits and double-entry accounting. Beginners welcome.

bench.co

bench.co